Paid-up capital is created when a company. All Singapore-registered companies paid-up capital of S500000 or more are automatically made.

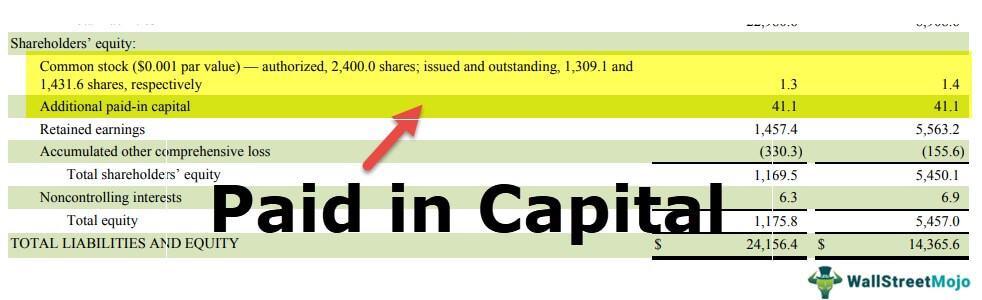

Paid-In Capital can be defined as the amount of cash or other assets that shareholders have given a company in exchange for a certain percentage of ownership within the company.

/GettyImages-1331517257-36d0dd704f42491589501360c249e64c.jpg)

. Retired Capital Stock shall have the meaning provided in Section 105b2. Provide the supporting document to your Company. The amount of CALLED-UP CAPITAL which shareholders have paid to date where a JOINT-STOCK COMPANY issues shares with phased payment terms.

Core Capital means fully paid up members shares capital issued disclosed reserves retained earnings grants. Additional Paid In Capital. Paid-up capital is the amount of money a company has been paid from shareholders in exchange for shares of its stock.

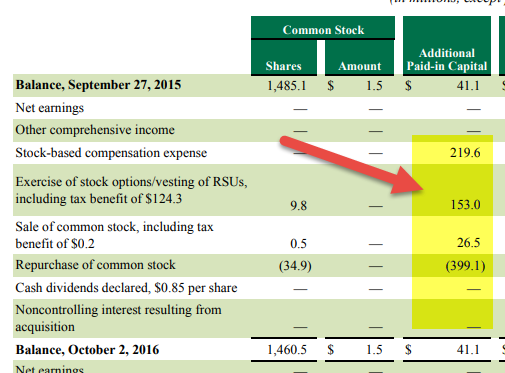

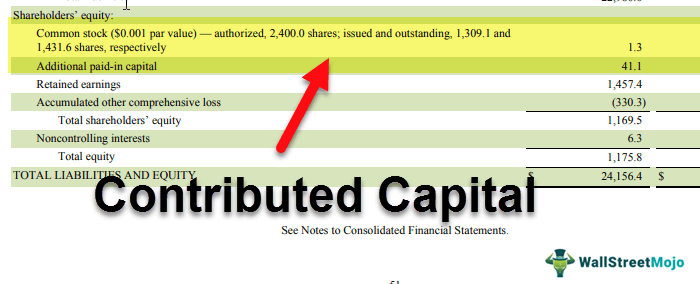

The par value of the stock and anything over the par value of the stock. However it breaks that 10 million up into two line items. Paid-in capital is the amount of capital paid in by investors during common or preferred stock issuances including the par value of the shares themselves.

General 1. Paid In Capital. Paid-up Capital means ordinary shares and non - redeemable preference shares that have been fully paid for.

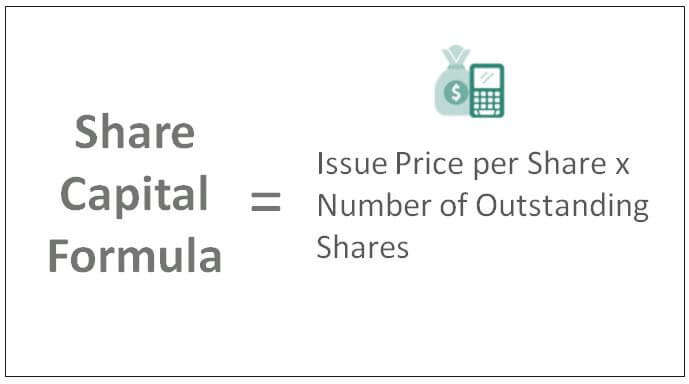

The number of total shares. Paid-up Capital has the meaning assigned to. Paid-up share capital definition.

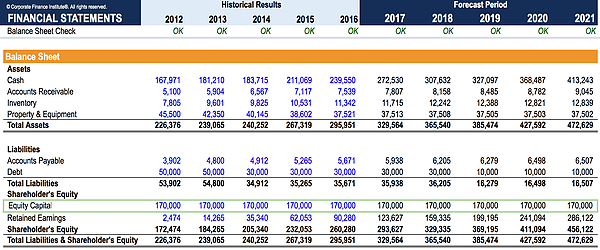

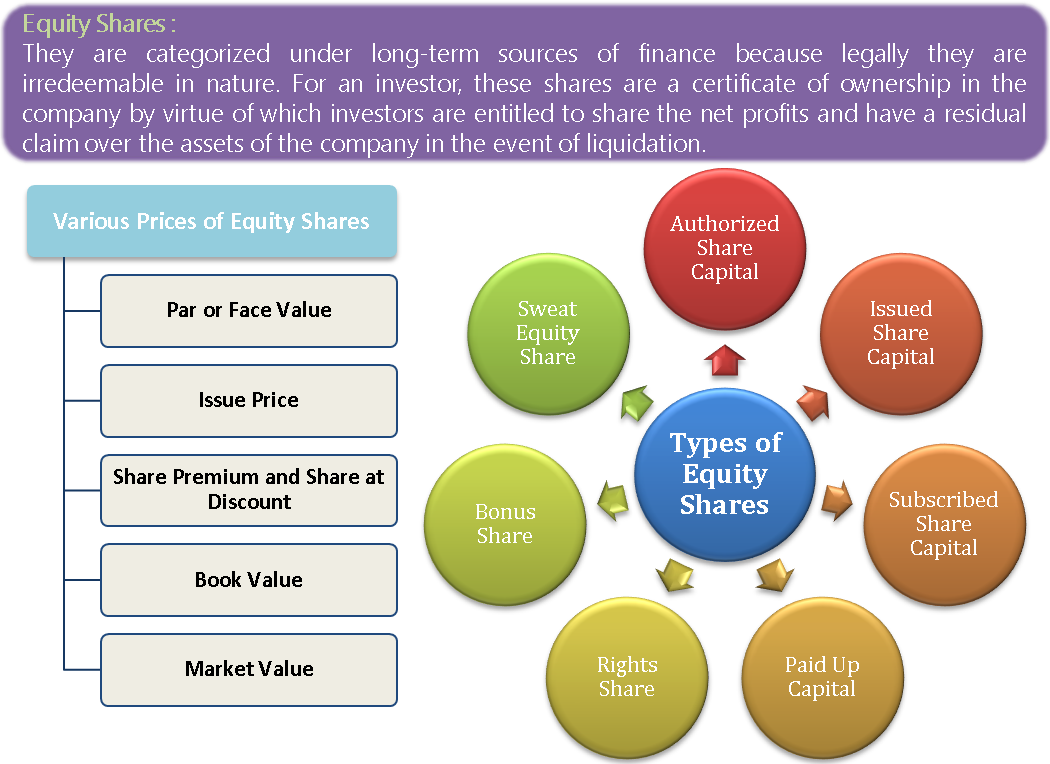

Issued share capital is referred to as the amount of the shares that a company has issued to the investors either privately or through the stock market. This is the reason why there may be a minimum paid-up capital requirement for companies. Authorized capital or authorized share capital represents the most significant number of the shares either preference or equity to the companys shareholders.

A companys paid-up capital figure thus represents the extent to which it depends on equity financing to fund its operations. The paid-up capital for a class of shares of the capital stock of a corporation is defined in paragraph b of the definition of paid-up capital in subsection 891. Additional paid-in-capital represents the excess paid by an investor over and above the par-value price of a stock issue and is often included in the.

This figure can be compared with the companys. Step 1 Contact your Company Secretary to prepare the paperwork. Having a high paid-up capital would mean that there are more monies to back the company up.

Traditionally companies assign an arbitrary par. Step 2 Transfer the funds or something of value to the Company. Paid-in capital is the amount of capital paid in by investors during common or preferred stock issuances including the par value of the shares themselves plus amounts in.

Singapore Business Federation membership with S500000 paid-up capital.

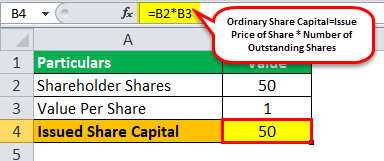

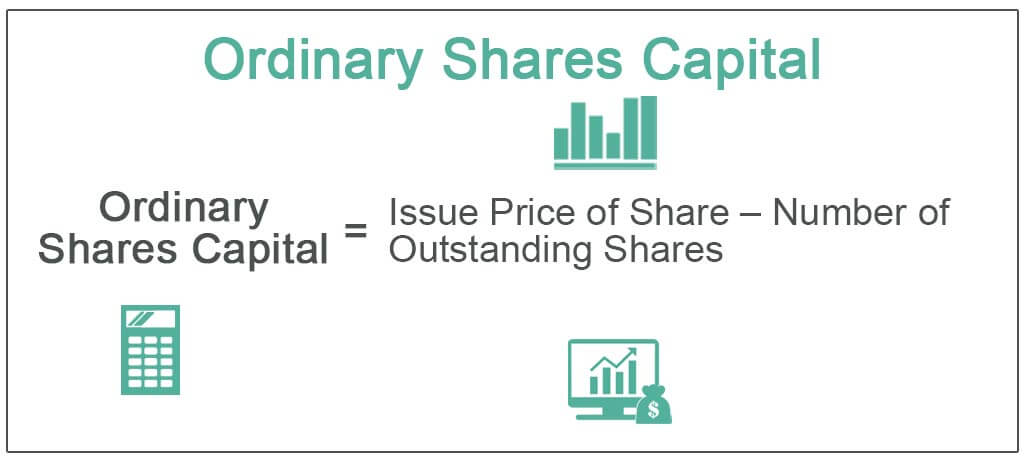

Ordinary Shares Capital Definition Formula Calculations With Examples

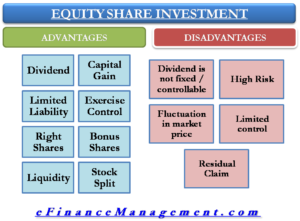

Advantages And Disadvantages Of Equity Share Investment Efm

/GettyImages-1331517257-36d0dd704f42491589501360c249e64c.jpg)

Called Up Share Capital Vs Paid Up Share Capital What S The Difference

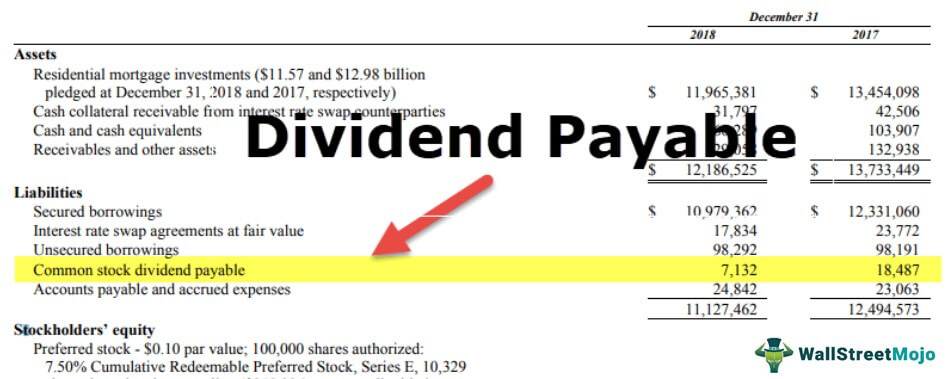

Dividend Payable Definition Examples Calculate Dividend Payables

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

Ordinary Shares Capital Definition Formula Calculations With Examples

Paid In Capital Meaning Examples How To Calculate

Difference Between Authorised Capital Vs Paid Up Capital Indiafilings

Paid In Capital Meaning Examples How To Calculate

/CapitalizationTable-5c8a59474cedfd000190b2a5.jpg)

Capitalization Table Definition

Share Capital Equity Invested By Shareholders And Investors

Difference Between Authorized Capital And Issued Capital With Example Faqs And Comparison Chart Key Differences

What Is The Difference Between Authorized And Paid Up Capital

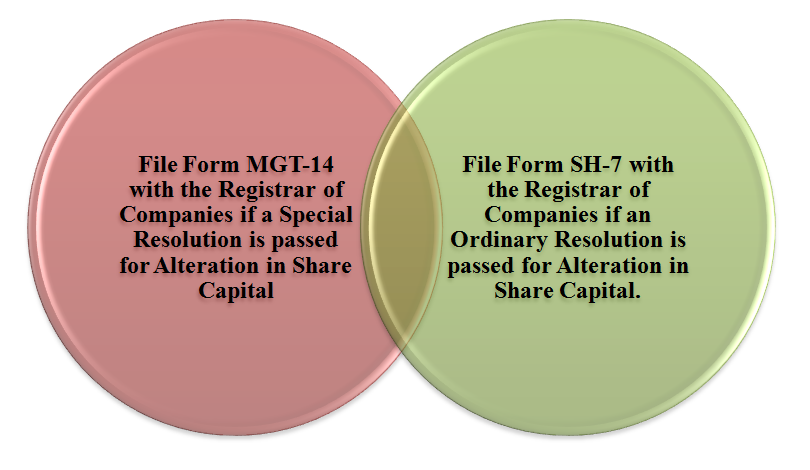

Procedure For Alteration In Share Capital Clause Corpbiz

Contributed Capital Definition Formula How To Calculate

Categories Of Share Capital Meaning Definition Example

Share Capital Definition Formula How To Calculate

/balancesheet.asp-Final-d803d4cbbabf4a1e8e1d18525ba6f85d.png)